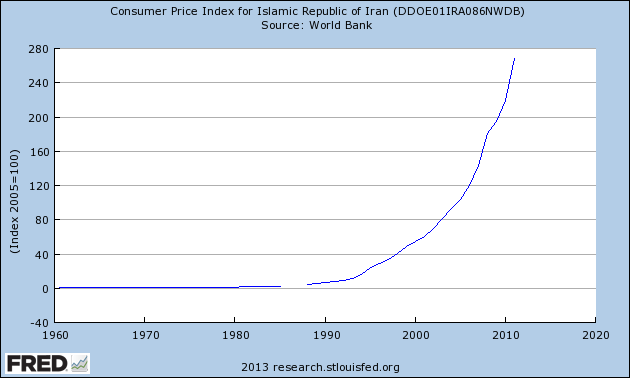

If we halt growth in money supply & reduce liquidity, we will be able to control inflation. Stats show this growth has been restrained.

— Hassan Rouhani (@HassanRouhani) November 26, 2013

This is cool! [1] Hassan Rouhani talking about monetary policy? Could I be any more excited? No.

Despite inventing zero, arabs have no use for it, [2] at least not when it comes to central banking. Lending money at interest is haram in Islamic finance so the use of interest rates to control demand as is normal in the west doesn’t apply. So does this also means that unlike in the UK and the US there is no danger of interest rates going to zero and the economy entering the liquidity trap?

Most reporting on Iran focuses at its very high inflation but nobody is paying much attention to the tools used by the central bank. This is understandable, inflation has skyrocketed and the central bank has no independence and is controlled by the Iranian state. My rhetorical question is largely irrelevant at the moment, but if we look at the tools Iran’s central banks uses the question is likely “yes”. I think we should look a little at the tools of Islamic central banking anyway as they give us a window into a world of central banking with interest rates or a zero rate problem.

To begin, a little history. The first Islamic savings bank was established in Mit Ghamr in 1963 by Ahmad El Najjar, an economist. In the 1960s Nasser was trying to modernise egypt and so the bank kept secret its overtly Islamic nature. Riba – charging interest – is haram so the saving bank operated on a profit share basis. Today, the much larger Islamic finance industry – in 2011 $1.357 trillion of shariah-compliant assets existed globally – has a variety of alternatives to charging interest.

Islamic finance seeks to avoid unearned income, which is seen as exploitative. Instead of lending money and charging interest, which is seen as just transferring risk, risk is shared through a variety of mechanisms; as profit sharing (Mudharabah), safekeeping (Wadiah), joint venture (Musharakah), cost plus (Murabahah), and leasing (Ijar). This can be illustrated with an example: Unlike in western finance a mortgage transaction does not involve interest payments. Instead the bank would arrange to buy the house from the seller and sell it on to the buyer at a profit with payments arranged as installments.This arrangement is called Murabahah and is the most relevant for our discussion of central banking.

Sukuk is also an important concept too. This is similar to a bond in which interest is regularly paid on a principal. However, because riba is haram in Islam it cannot be structured like this. Instead sukuk imply a transfer of ownership and can look like a form of repurchase agreement. You agree to repurchase something at a certain price over a certain period of time. This echoes previous posts of mine of what saving really is. Interest rates are just symbolic, what is really happening is people buying durable things today with an expectation they will be able to sell them on for more in the future. Interest rates are our way of expressing that, Murabahah or Sukuk are another. The latter seems clearer and more honest on the mechanism actually.

(At this point, I do want to point out to all the snooty economists, engineers, mathematicians who mock post-modernism…who’s laughing now?)

So what does all this mean for Islamic central banking? The most prominent method of controlling monetary policy is the control of the profit rates allowed by banks when they lend, the Mudharabah discussed above. Anything from an 18% to 20% on non profit-and-loss sharing arrangements, and slightly lower on profit-and-loss sharing arrangements. In a country shrinking around 5% a year finding a 20% return implies a high rate of nominal GDP growth which is split between negative growth and even higher inflation.

We can see that the implied maximum profit rates require very high growth in nominal incomes and we also see very fast growth in the monetary base. Entering into a profit-and-loss agreement will guarantee you a high nominal return in a low growth environment and monetary growth is high to accommodate these contracts. There is no reason however that the profit share cannot be set to a lower number. This would amount, via the Kalecki equation, [3] to a monetary tightening and NGDP and inflation would both have to decrease to accommodate this lower allowable rate of profit. Weirdly a shrinking of the nominal profit rate could increase it in real terms. Money is weird.

This piece from Cato, caveat lector, says that Iran stopped publishing information on its money supply in March 2011, at the time they showed continued very rapid growth in the money supply. If Rouhani has changed this that’s great. The country’s monetary policy at the moment is chaotic but once the chaos fades it will be useful to bear in mind how Islamic monetary policy works. The details in this post are broad sketches only. I took lots from these documents [1, 2, 3, 4, 5] and I’m not sure of their quality. This is an area where I don’t even know anyone who might know an expert, so any input in the comments or on twitter is welcome. Likewise please share this as this might get picked up by someone better informed than me.

_____

[1] Yes. Cool. You’re here aren’t you?

[2] Yes. Persian or Iranian is more appropriate but I’ve been looking for a chance to use that line since I drafted this post months ago. UPDATE: As Lorenzo tells me, actually the Indians invented zero as a concept, the Arabs were miles behind. More here.

[3] I’m making the Kalecki equation [1, 2, 3] do some heavy lifting here, but I think that’s right…

You must be logged in to post a comment.